With the NY Forward plan in place, businesses in New York are anticipating and preparing to reopen.

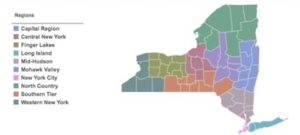

The Plan divides New York State into regions. Each region will be allowed to reopen businesses in four phases with at least two weeks between each phase, as long as the region meets certain criteria set by the NY Forward Plan and is monitored by state and local government officials.

The Plan divides New York State into regions. Each region will be allowed to reopen businesses in four phases with at least two weeks between each phase, as long as the region meets certain criteria set by the NY Forward Plan and is monitored by state and local government officials.

The Plan is meant to prioritize businesses considered to have (a) a greater economic impact; and (b) inherently low risk of infection to workers and customers, followed by businesses considered to have (a) a lower economic impact; and (b) present a higher risk of infection to workers and customers.

As we plan to reopen, business owners must adopt a plan and set processes to protect your employees and consumers to lower their risk of infection through your business and ensure that your plan protects your business from consumer liability.

ADOPT A PLAN AND PROCESSES TO SAFELY REOPEN

- Protections for employees and customers. This includes possible adjustments to workplace hours and shift design as necessary to reduce density in the workplace; enacting social distancing protocols and restricting non-essential travel for employees.

- Changes to the physical workspace. This includes requiring all employees and customers to wear masks if in frequent close contact with others and implementing strict cleaning and sanitation standards.

- Meeting public health obligations. This includes screening individuals when they enter the workplace and reporting confirmed positives to employees and consumers.

While these processes will vary from business to business, almost every business will have to adapt, in some way or another, to our new normal.

(New York Forward Reopening Guide: A Guide to Reopening New York and Building Back Better, p.33)

REVIEW YOUR GENERAL LIABILITY POLICY

- Review your general liability policy for language that protects (or excludes) your business from risks associated with COVID-19. This should be done with your lawyer or insurance broker, so you have a full understanding of what protections your insurance policy provides (and doesn’t).

- Consider what legal responsibility you will have if there is an outbreak of COVID-19 at your business, either with an employee or consumer.

- Contemplate what you can do to mitigate your risk. This should be included in your Plan and should include such processes as hand sanitizing, temperature-taking, facility and equipment sanitization, social distancing, mask requirement, reconfigured space planning, etc.

LEGALITY OF COVID-19 WAIVERS

How will New York Courts interpret COVID-19 waivers? Will they treat COVID-19 language like all other previously enforceable waiver language? Will they even entertain COVID-19 claims given it is a global pandemic? If so, to what extent and will there be exclusions? No court has been in this position before now, and we await direction on such. However, businesses should err on the side of caution and put COVID-19 waivers in place, where appropriate.

If you are a business with current waivers in place with consumers, update the waiver and release language to include COVID-19. If you are considering implementation of new COVID-19 waivers, ensure that the waiver specifically waives all COVID-19 claims for illnesses up to an including death. Any such waivers are best prepared by legal counsel to safeguard that it is best drafted for future enforceability.

As you consider your plans to reopen your business, the attorneys at Monaco Cooper Lamme & Carr, PLLC are here to answer any questions related to these issues.

___________________________